Ever had one of those days where a tiny choice changes everything? Maybe you skipped a train, bumped into a stranger, and your whole afternoon shifted. That’s how the global economy works—small moves in one place set off ripples that reach every corner of the world.

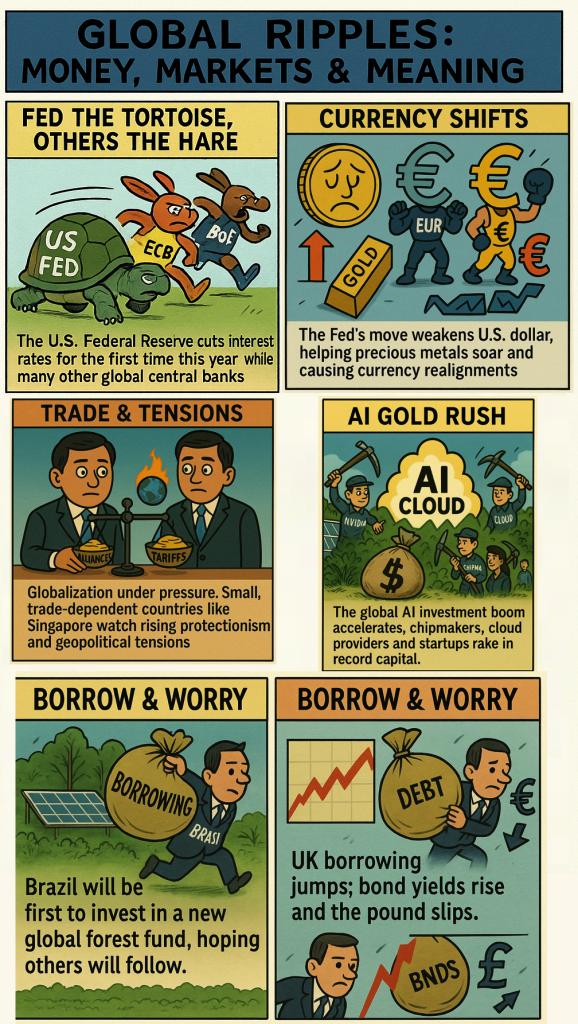

The U.S. Federal Reserve recently cut interest rates by 25 basis points. A cautious step, but one that carried enormous weight. The Fed is like a tortoise, moving slowly while others—the European Central Bank, the Bank of England—dart around at their own pace. At 11 Wall Street, New York, traders leaned forward because even a modest decision there can alter the mood in Frankfurt, Delhi, or Johannesburg.

And sure enough, the ripple hit quickly. The U.S. dollar weakened, gold and silver surged, and the euro and yen flexed like athletes in peak form. On Oxford Street in London, shoppers don’t see currency charts, but they do notice when imported clothes or electronics edge up in price. Exchange rates have a sneaky way of turning macroeconomics into micro-moments at the checkout counter.

Global trade is feeling the strain too. Protectionism is rising, and geopolitical tensions are sharpening. Picture a tightrope suspended between “Alliances” and “Tariffs.” Nations must tread carefully because one slip rattles everyone. At La Défense in Paris, glass towers gleam with international finance—but behind the shine, executives worry about fragile supply chains and political fault lines.

Brazil, meanwhile, is playing offense. It just became the first country to invest in a global tropical forest fund. Tropical forests aren’t just greenery anymore—they’re carbon vaults, and carbon now carries a price tag. This isn’t charity; it’s a long-term investment in credibility, influence, and climate resilience. Walk through Parque Ibirapuera in São Paulo, and you’ll see families enjoying a green space. Scale that vision up, and you understand Brazil’s bet: forests as both heritage and financial strategy.

While Brazil plants, others dig—into AI. The global AI boom looks like a digital gold rush. Instead of miners with pickaxes, we see engineers with GPUs, startups with billion-dollar valuations, and regulators sprinting to keep pace. In Shenzhen’s Nanshan District, skyscrapers beam with glowing AI logos. In San Francisco’s SoMa, coffee shops buzz with founders pitching AI products over lattes. The hum of servers and the chatter of venture capitalists are today’s soundtracks of growth.

But not everyone is racing toward the future. In the UK, borrowing has jumped sharply. Bond yields rose, the pound slid, and consumer confidence weakened. Imagine dragging a heavy sack marked “BORROWING” uphill while the slope gets steeper with every step. At 10 Downing Street in London, the air feels heavier—each policy choice burdened by yesterday’s debt.

All of these threads—interest rates, currency swings, forests, AI, debt—are stitched together by one truth: global decisions hit home in local ways. Whether it’s your grocery bill in Berlin, your rent in Sydney, or your energy costs in Nairobi, the ripples are real.

Notes & Invitation

- This guide is written for reflection, not as a news report.

- Shops, cafés, or events mentioned may change in availability, so always check before heading out.

👉 Subscribe to NgageGo.com

Finance Comic Quiz 📊

Test yourself on this week’s global money ripples!

Leave a Reply