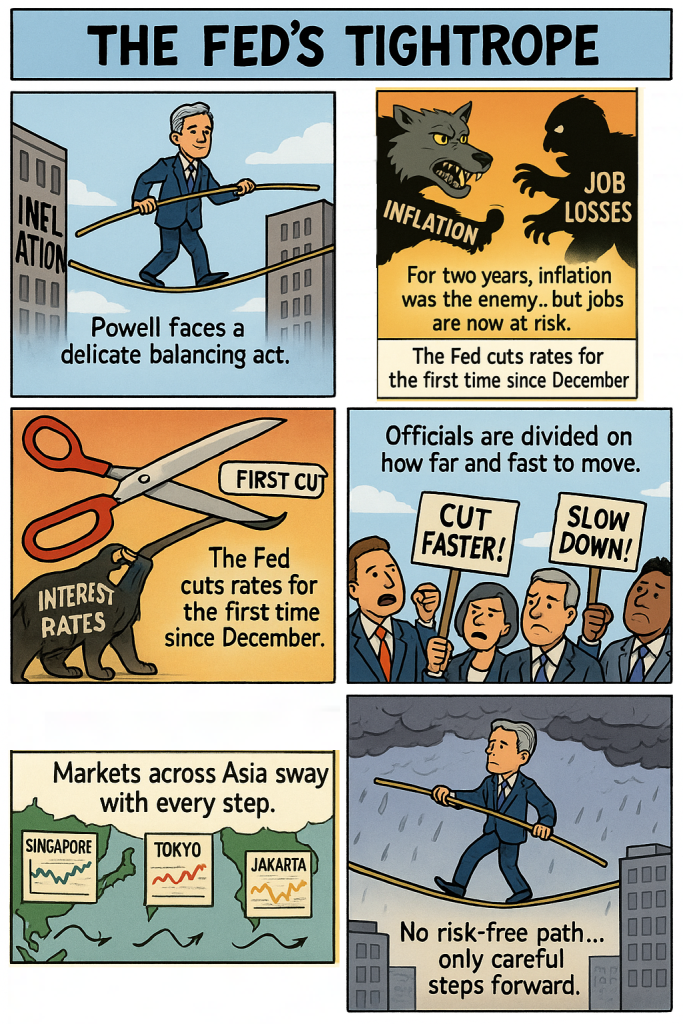

Ever tried walking a tightrope with the wind blowing hard from both sides? That’s pretty much the position the U.S. Federal Reserve finds itself in today.

For nearly two years, the Fed had one clear mission: crush inflation. A strong job market gave it cover to hike rates aggressively, confident the economy could handle some pain. But the story has changed.

🎥 Federal Reserve Chair Jerome Powell speaks on economic outlook

( credit – https://www.youtube.com/live/gXXd6Zesdrc?si=Ms6TcKI8j7Q3Gn-n)

🔄 A Shift in Focus

At its latest meeting, the Fed trimmed rates for the first time since December. Why? The job market is cooling: fewer new jobs, rising unemployment, and a sense that the risks are no longer one-sided.

- Yesterday’s villain: runaway inflation.

- Today’s challenger: rising unemployment.

Powell summed it up plainly: “There are no risk-free paths now.”

📊 What the Fed Plans Next

- Policymakers expect two more cuts this year, up from earlier forecasts.

- The famous “dot plot” is scattered — Fed officials disagree on how fast and far to ease.

- One voice, Governor Stephen Miran, even pushed for a bigger cut, showing just how divided the committee is.

- Powell stressed the Fed’s independence, a reminder that political winds (especially in an election year) won’t dictate every move.

💵 What It Means for You (Yes, Even in Asia)

So, how does this balancing act echo from Washington to Singapore?

- Loans & Credit Cards → Borrowing costs may inch lower, but don’t expect overnight relief.

- Savings Accounts → Deposit yields likely peaked; banks could start trimming rates.

- Investments → Stocks often cheer rate cuts, but if cuts signal economic weakness, that party may not last. Bonds, meanwhile, tend to benefit from lower yields.

- Regional Impact → Asian markets, from Singapore REITs to Japan banks, react to Fed shifts. Currencies like the SGD, rupiah, and baht can swing overnight.

🌏 Why This Moment Matters

This is one of the trickiest balancing acts the Fed has faced in years. Inflation isn’t fully tamed, but the job market is no longer bulletproof.

- Cut too fast → inflation could flare up again.

- Hold too tight → unemployment worsens.

Either way, risks are real. And for businesses, and investors in Asia, it means more volatility — not just in stock charts, but also in exchange rates, borrowing costs, and day-to-day financial planning.

✅ Takeaway

Think of Powell’s Fed as a tightrope walker — moving carefully, adjusting for every gust.

How do you see Fed decisions touching your daily life — through mortgages, investments, or even travel budgets? Share your story below; it helps connect global headlines to neighbourhood realities.

👉 Subscribe to NgageGo.com to leave a mark here! Bookmark this page to keep connected.

⚠️ Disclaimer

Information here is based on Fed announcements and market data current as of September 2025. Shops, events, and financial conditions may shift quickly; always check with official sources before making financial or lifestyle decisions. This content is for informational purposes only and does not constitute financial advice. Always do your own research or consult a licensed professional before making financial decisions.

Leave a Reply