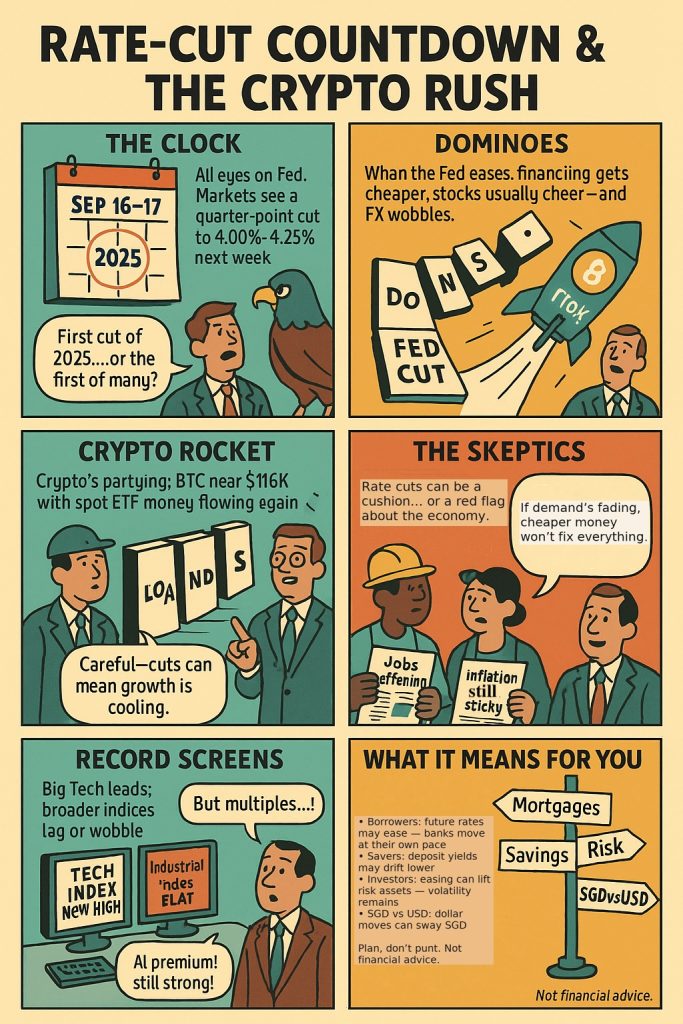

Two fun facts to start: the Fed meets Sept 16–17, and gold just notched fresh record highs above $3,600/oz. Oh—and crypto is back in the headlines with fat ETF inflows. If you’re feeling equal parts excited and whiplashed, you’re not alone.

The 60-second brief

- The event: The U.S. Federal Reserve’s Sept 16–17 policy meeting (press conference right after). Markets lean toward a 0.25% cut, the first since late 2024, even as the Fed navigates unusual political noise.

- Gold: Record territory above $3,600/oz as investors front-run lower real yields and a softer dollar.

- Crypto: Bitcoin has traded around the $110–120k zip code this year; U.S. spot BTC ETFs just logged >$550M in a day—their fourth straight day of net inflows. Momentum is back.

Why a rate cut matters (wherever you live)

Cuts lower the cost of money, which can:

- ease borrowing (mortgages, corporate loans),

- lift growth stocks (future cash flows get pricier today), and

- pressure the U.S. dollar, which ripples through emerging-market FX, commodities, and global trade.

But—there’s nuance. If cuts arrive because growth is cooling, risk assets can rally and wobble. It’s not “cut = everything up forever.” It’s “cut = cheaper money, but mind the macro.”

Gold: back in the spotlight

Gold tends to shine when real yields fall and policy credibility is questioned. That’s the cocktail on the table now, and why bullion pushed to fresh highs above $3.6k/oz in the run-up to the meeting. Historically, periods of negative real rates have been kind to gold; investors treat it as a hedge against inflation and currency risk.

TL;DR: If the Fed sounds dovish and the dollar slips, gold’s floor gets sturdier. If the Fed surprises hawkish, expect a quick gold pullback (yields ↑, USD ↑).

Crypto: ETF fuel and macro winds

Bitcoin’s 2025 arc has been driven by two engines: institutional access via ETFs and the macro easing narrative. Data trackers show four straight days of net inflows into U.S. spot BTC ETFs (>$550M in a single day), and Reuters’ running visual notes BTC set records this year on adoption and ETF demand. Translation: the pipes are bigger now, so macro news (like a rate cut) travels faster through prices.

Caveat: Crypto loves liquidity… until it doesn’t. Post-decision volatility can be savage—position sizing beats bravado.

Equities: “AI premium” vs. “multiples anxiety”

Expect the usual split screen: long-duration tech tends to cheer easing first; cyclical/old-economy names react more to growth signals and the dollar. If guidance tilts “one-and-done,” multiples may compress; if the Fed implies a cycle, dips can get bought. (Yes, you can have both in the same week.)

Practical playbook (global)

- Borrowers: Check your reset cadence (monthly/quarterly) on floating-rate loans. Ask your bank how –25 bpswould filter into your payment schedule.

- Savers: Expect deposit rates to drift lower if the easing cycle takes hold; consider laddering maturities.

- Investors: Revisit risk budget and rebalancing rules before the press conference. Volatility clusters around central-bank days.

- Gold curious? Compare total premium (per gram/ounce) across bars/coins; the spread matters more than spot.

- Crypto curious? If ETFs are available in your market, understand fees, tracking, and custody. Avoid chasing vertical candles.

Takeaway

Plan, don’t punt. Rate cuts can be a tailwind, but they don’t cancel risk. Map your cash flows, diversify sensibly, and give future-you a calmer ride.

Your turn: Where are you reading from, and what’s your biggest question about this week’s decision—mortgages, gold, or crypto? Drop a comment below. If this helped, subscribe to our 2-Minute Finance Digest so you’ll catch the next comic + explainer.

Not financial advice. No opinions, endorsements, or forecasts. Data is descriptive and time-stamped; figures may change after publication.

Leave a Reply