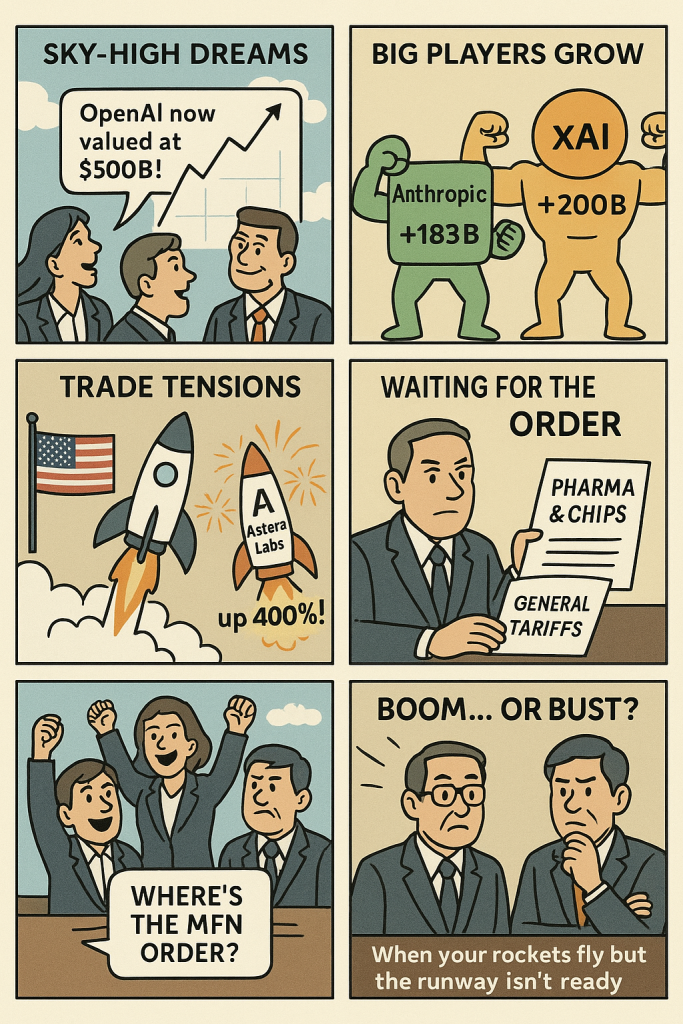

Have you ever watched a rocket shoot into the sky—only to realize the runway it launched from is still under construction? That’s exactly what’s happening in the global economy right now. On one side, AI startups are climbing to jaw-dropping valuations. On the other, trade deals that affect everyday goods—like chips and medicine—are stuck in negotiation limbo.

Let’s break it down together.

💡 The AI Gold Rush: Facts You Should Know

- OpenAI just hit a staggering $500 billion valuation in private markets.

- Anthropic is valued at $183 billion, while Elon Musk’s xAI sits at $200 billion.

- AI-related IPOs are booming:

- CoreWeave has more than doubled since going public in March 2025.

- Astera Labs is up 400% since its 2024 debut.

- Investors are piling in, calling this the biggest tech wave since dot-com.

👉 Reflection: Remember the dot-com bubble? Some rockets flew, others exploded. The same risk applies here—huge upside, but also high volatility.

⚖️ Trade Tensions: Why Japan Matters

- The U.S.–Japan trade deal is still unsettled.

- Japan demands “most-favored-nation” (MFN) orders on pharmaceuticals and semiconductors before signing.

- Without these guarantees, Japan fears being sidelined in the global chip race.

- Automakers in Tokyo are already nervous about how U.S. tariffs will reshape competitiveness.

👉 Reflection: If chips are the “brains” of AI, and trade deals decide who gets them cheapest, then the AI rocket may depend on Japan’s runway.

🤔 What Does This Mean For You?

Let’s bring this back down to earth—our everyday lives:

- Investors in Singapore: Watching Nvidia or AI-linked ETFs? These stories will shake your portfolio.

- Business owners: Higher chip or medicine prices from tariffs could affect local costs.

- Everyday consumers: From laptops to cars, don’t be surprised if prices feel the ripple effect.

✨ Takeaway

AI may be the rocket of our generation, but without stable trade agreements, it risks taking off from a half-built runway. The truth? Both stories matter—your investments, your tech gadgets, and even your medicine prices are tied to this dance between Silicon Valley dreams and Tokyo negotiations.

💬 Let’s Talk

Do you see this moment as an opportunity to invest in AI, or are you more worried about the risks of global trade uncertainty? Drop your thoughts below—I’d love to hear how you’re interpreting these shifts.

👉 Subscribe to Ngagego.com

Leave a Reply