How a Wild Week on Reddit Shook the Markets Again

“My portfolio was up 430% on Tuesday… and down 80% by Wednesday. I didn’t even blink.”

Sound familiar? If you’ve been lurking on Reddit lately or scrolling through your finance app, you’ve probably seen it: meme stocks are back—and louder than ever.

From Opendoor to Kohl’s, and even Krispy Kreme and GoPro, 2025 has revived the chaotic energy of the 2021 GameStop saga. Only this time, it’s a little weirder, a lot faster, and possibly fueled by… a celebrity ad?

Let’s break down what’s going on—and what you should know if you’re watching the market, in the game, or just here for the drama.

What’s the Big Deal?

The market’s been wild this week, but here’s what you actually need to know:

🥯 Who’s Involved?

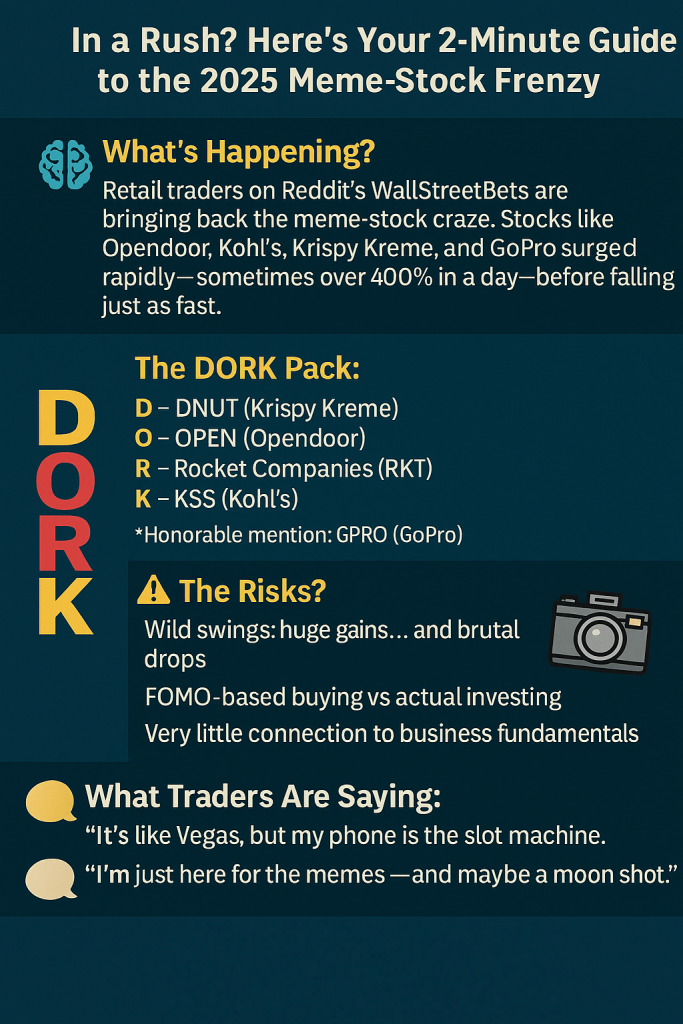

A group of tickers lovingly called the “DORKs” (yes, really):

- D – DNUT (Krispy Kreme)

- O – OPEN (Opendoor)

- R – Rocket Mortgage (RKT)

- K – KSS (Kohl’s)

- GPRO – GoPro also joined the hype pack.

📈 What Happened?

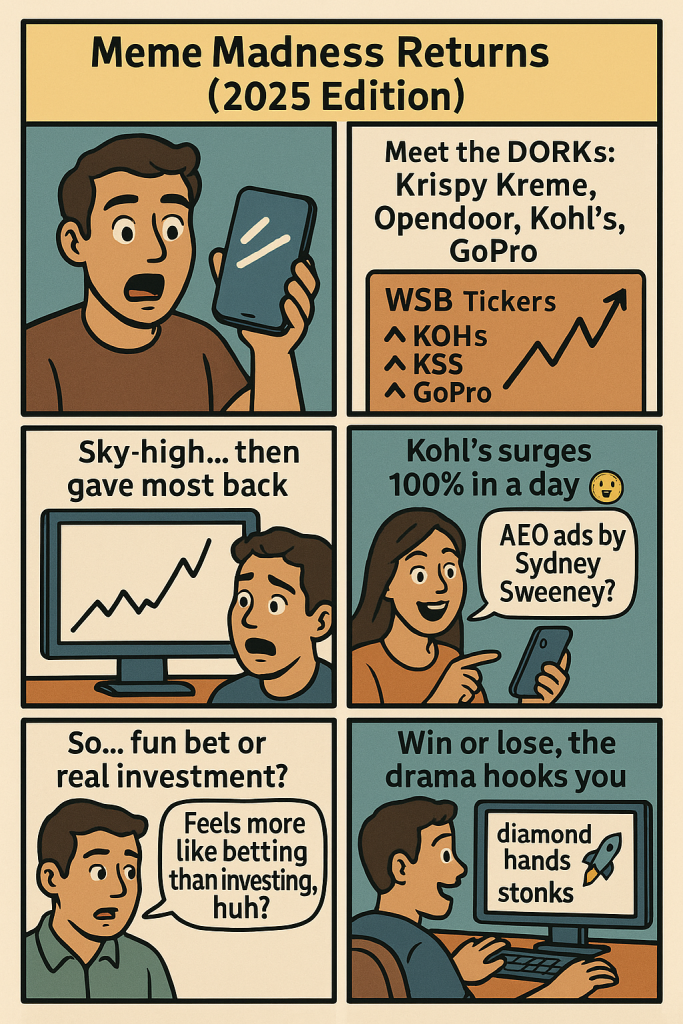

- Opendoor soared over 440% within hours, then crashed 20% by the next day.

- Kohl’s jumped 100% in one trading session, allegedly after a viral Sydney Sweeney ad for American Eagle (AEO).

- Retail traders on WallStreetBets (WSB) pushed the surge—citing nostalgia, rebellion, and, well, memes.

- Institutional investors? Mostly stayed out… for now.

💬 Real Talk: Investing or Just Vegas?

Let’s face it, watching stocks moon and nosedive in hours feels more like blackjack than investing. And yet, millions are jumping in.

“Feels more like fun money than investing,” one Redditor wrote.

This “betting for fun” culture has a psychological pull. It’s fast. It’s risky. It’s emotional. For some, it’s even community bonding. (Diamond hands, anyone?)

But make no mistake:

- These moves often ignore company fundamentals.

- Many traders are playing with cash they can lose.

- Some treat it like entertainment—with real dollars on the line.

🤔 Should You Join In?

Only you can answer that. But here’s how to think about it:

- Can you afford to lose what you invest? If not, sit this one out.

- Are you following FOMO or doing research?

- Is it part of a broader strategy—or just chasing the hype?

If you do dip in, treat it like a poker night, not your retirement plan. And always use limit orders. Meme stocks don’t care about your emotions—or stop losses.

📉 What Does This Say About the Future of Investing?

- Meme-stock madness signals a cultural shift in how people relate to money:

- Financial education is evolving. People are learning through experience, even if it’s messy.

But this comes with responsibility. Hype is fun—until someone gets margin called.

So if you’re riding the waves of OPEN, KSS, or GPRO… keep your life vest handy. ✌️

🔍 Helpful Resources to Bookmark

Want to go deeper or stay in the loop? Start here:

- ✅ Reddit: r/wallstreetbets – The meme-stock movement HQ

- ✅ Yahoo Finance: Meme Stocks Tracker – Real-time stats

📍 From Your Local Neighbourhood to the Meme Markets

Whether you’re sipping kopi or scrolling from Marina One Residences, the meme madness has reached you. These surges reflect something deeper:

📉 A growing distrust in institutions.

📲 A belief in people-powered markets.

🎭 And yes—sometimes, the pure thrill of chaos.

🫱 Your Turn — Join the Conversation

Have you jumped into meme stocks recently?

Did you make a sweet gain… or feel the sting of the dip?

Or are you just here for the popcorn?

👇 Share your story in the comments below.

📌 And don’t forget to bookmark this article + subscribe to Ngagego.com

📍 You’ll connect with your nearest neighbourhood.

🔗 Subscribe to Ngagego.com

Don’t just scroll—get involved in your neighbourhood’s financial future.

✅ Subscribe to Ngagego.com

✅ Bookmark this article and connect with your nearest neighbourhood to leave a mark

✅ Share your trading story in the comments!

💡 Final Thought

The return of meme-stock madness is a mirror. It reflects our desire for impact, connection, and maybe a little rebellion. Whether you’re diamond-handing or sitting on the sidelines, one thing’s clear:

Win or lose, it’s the drama that hooks us.

So… are you in?

👇 Drop a comment below: Have you YOLO’d lately? Or are you waiting for the next dip to buy in?

⚠️ Disclaimer

Stock trends and availability of shops (especially investment-related pop-ups) vary by region. Always consult a certified advisor before investing. This article is for educational and entertainment purposes only. Shop and investment feature availability may vary. Ngagego.com does not offer licensed financial advice.

Leave a Reply